Buying a home is a substantial monetary and private milestone, signaling the shift from renter to homeowner. For initial-time homebuyers in Texas, deciphering the complexities of house loan options can be too much to handle.

If you do not have a longtime credit record or You should not use traditional credit, your lender should receive a non-traditional merged credit report or acquire a credit record from other usually means.

Texas gives 1st-time homebuyers a wide variety of alternatives, ranging from deposit support to homebuyer education courses, that help Texans with their homeownership plans.

Sufficient cash flow: Your earnings ought to be more than enough to comfortably cover the mortgage loan payment, residence taxes, homeowner's insurance policies, and various housing expenses.

Predicting future shifts in FHA loan rules is about as difficult as predicting the Texas climate. Financial problems, policy alterations, and perhaps demographic shifts can cause ripple effects.

For example, although the most borrowing total for an FHA loan in expensive states like California would be larger to account for the upper home selling prices, the ceiling in Texas is set at a far more average $472,030 – sufficient for just one-spouse and children home in the majority of counties.

Skipped payments can severely harm your credit score — and they will stay in your credit experiences for around pay via echeck seven several years. To stay away from late or missed payments, take into consideration signing up for automated payments where attainable.

Accurately calculating your property finance loan generally is a important first step when deciding your budget. The loan total, the interest rate, and the expression of the house loan might have a dramatic effect on the overall amount you may eventually purchase the property.

In essence, the FHA loan requirements serve as a safeguard, guaranteeing you're Completely ready and effective at endeavor a mortgage loan. Conference these requirements provides you a action closer to owning your dream home in Texas.

Texas FHA loans could possibly be a match-changer if you're looking to purchase a home but are concerned about your credit score.

An FHA requirement with regards to huge non-payroll deposits is kind of normally missed. Just about every borrower is required to offer a credible rationalization and documentation from the supply of cash exactly where the big non-payroll deposit arrived from.

Keep in mind that the pre-approval method is An important preemptive stage. Lenders assess your financial circumstance and issue a letter indicating the most loan sum you might be qualified for. This increases your negotiating position and shows real shopping for intent.

Immediately after we obtain all your paperwork — your application package, the appraisal and the title do the job — we will Speak to you to schedule your loan closing. For anyone who is paying for a home, we will also routine the closing with the real estate property broker and the seller.

Yes, acquiring a personal loan without any credit is feasible. Some lenders concentrate on featuring little loans to borrowers who may have a very poor credit historical past or no credit historical past in the least.

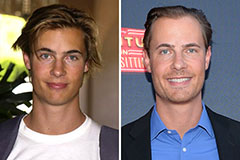

Erik von Detten Then & Now!

Erik von Detten Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!